Land reform is an emotive topic for both landless and landlords but one that is not going to fade away anytime soon.

The landless are restless for tangible progress while the landlords are protective of property rights. As a way to pacify the landless, landlords point to evidence that the 30 percent target is soon to be achieved and the government should therefore ready itself to put the proverbial foot off the pedal.

For starters, it should be remembered that the 30 percent target was a recommendation by the World Bank, which the government adopted as a land reform policy position. Its adoption, however, supports the worldwide view that inequality everywhere is by policy design. Specifically, and as Thomas Piketty pointed out in the ‘Capital in the Twenty-first Century’, along with educational and fiscal regime, property regime determines the structure and evolution of societal inequality. Land as a source of rents and profits is among key contributors to income and wealth inequality. In addition, and as South Africa’s banks are still security-based lenders with land as the prime security, the landless face uphill battles when raising finance.

Despite the unique history of South Africa, land reform is remains topical for several other reasons: The progress has been slow and most of the land reform projects have failed. Some of the contributing factors to dismal performances are skills deficiency, lack of market access and limited access to finance. Two other contributing factors, which are rarely mentioned, are lack of ‘skin in the game’ by, and poor group dynamics among, beneficiaries who are non-family members. Without ‘skin in the game’, beneficiaries find it easy to abandon farming when the going gets tough.

Though the target could be reached in theory, the reality could be far from the target in terms of productive employment of land. In line with the Pareto Principle, 20 percent of the farmers, commercial farmers, account to 80 percent of the total agricultural output and appropriate same percentage of the total agricultural gross value add.

Capital, including land, also has a tendency to re-concentrate into the hands of the previously advantaged (i.e. the target of land reform in this case).

This article focuses on the role of one endogenous factor, fixed cost, in causing financial strains on many private market-based land reform projects, not those redistributed through of PLAS that are however plagued by lack of ‘skin in the game’.

Agricultural land was valued at ca R418 billion in 2023, up from R305 billion in 2020, representing a compound annual growth rate of 11 percent over the last four years. Any farmer selling his farm would expect, on average, capital appreciation of at least 11 percent. This means that the fixed cost component associated with debt-financed private market-based land reform should increase by the same percentage, assuming constant interest rate. The total agricultural debt is just over

R200 billion. However, not all agricultural debts were incurred to acquire farms but farm mortgages are significant portion. Stated somewhat differently, much of the farmlands have associated fixed costs – crucial determinant of break-even point, a point of zero profits where total income exactly equals total cost.

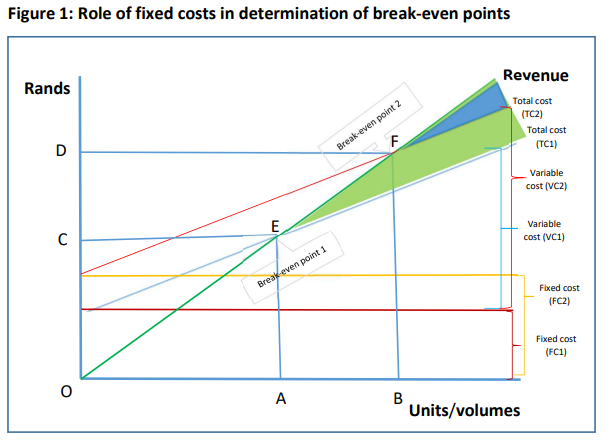

To illustrate this point, let us assume Farm A with a starting fixed cost at FC1 (refer to the figure 1 below). Adding variable cost to FC1 takes total cost to TC1. At this level, the farm’s break-even point is at E (Break-even point 1). Beyond E, the farm starts turning a profit, represented by a green shaded area. At E, the farm has a long runway for increasing profits. When an owner sells the farm with at least 11 percent of capital gains, ex post fixed cost should be higher due to higher mortgage to finance the acquisition. Let us say that the fixed cost of the newly acquired farm increases to FC2. Adding the same amount of variable cost to FC2 increases total cost to TC2. This exercise implies same level of productivity. At TC2, the farm’s break-even point is now at a higher level, point F

(Break-even point 2), requiring the farm to produce more output, OB as opposed to OA. Not only is the farm required to produce more volumes, the level of available profitability shrinks as represented by a smaller blue triangle.

There are two ways the farm can operate at or beyond F: 1) intensify the application of variable inputs, in which case variable cost increases in tandem leading to an increase in total cost from C to D; and 2) improve productivity – produce more while applying same/less variable inputs. The first option runs the risk of encountering the law of diminishing marginal returns, which is as universal as Newton’s law of gravity. The new farm owner cannot hope to continue applying more and more variable inputs expecting to harvest more and more outputs up to infinity. At some, a saturation or optimal point is reached, beyond which production flattens out and start declining. Therefore, without improving farm productivity, the newly acquired farm is doomed as its success is conditional on producing more outputs just to break-even.

This is one of the main reasons most business acquisitions are immediately followed cost-cutting measures to ensure that break-even volumes/levels of service do not relocate to higher level due to higher fixed cost associated with acquisitions. Instead of being at F, new owners would still want to be at E with OA as the required operating level to break-even. Cost- cutting measures improves the probability of acquisitions becoming successful. With land reform, this challenge is compounded by the steep learning curve that faces land reform beneficiaries.

Therefore, making a success of private market-based land reform initiatives require significant improvements on farm productivity, post the acquisitions. Alternatively, a farmer can pivot to high value agricultural ventures or introduce additional products lines. This option would however still require significant financial outlays, which in turn may drive fixed cost even higher. However, most buyers do not change the core nature of their respective farms, meaning productivity improvements become their only saving grace. There are instances where resource-rich new owners completely change the core nature of their farms while others may add new product lines. These ways, the required break-even points could still be higher but the high value nature of the new crops or new higher margin products improve profitability, financial sustainability, returns on investments and ultimately produce successes.

From the above, it should be clear that land reform farms should be encumbered as little as possible. This is where Blended Finance of the government comes in. This financing initiative should be lauded and applauded for its innovativeness. The Blended Financed farm acquisitions have significantly lower fixed costs, which lower the required operating levels to break-even, improving probability of financial sustainability and ultimately inclusivity in the agricultural sector. The one benefit of the debt component in Blended Finance lies in its ability to instil financial discipline.

One last point, as I conclude, the high failure rate of land reform projects and the tendency of capital to re-converge into the hands of the previously advantaged should imply that land reform should have no end date. In other words, the program should be a regular feature of any democratic government, in perpetuity, to ensure compliance with the land reform policy. Therefore, every two or three decades, a survey should be conducted to determine the state of agricultural land ownership, which should then inform appropriate redress and just redistributive policies. And the government should be at the centre, providing part financing of the program and other complementary support measures.

Disclaimer: Views expressed in this article are solely those of Robert Matsila in his personal capacity.