By Ms Thandeka Ntshangase & Dr. Moses Lubinga,

Agro Food Chains Unit, Natonal Agricultural Marketing Council

A recovery period might be imminent after a difficult summer crop season in 2023–2024, during which South Africa’s production of grains and oilseeds dropped by 24% year-over-year (y-o-y) to 15.4 million tons. The Crop Estimates Committee (CEC) released information on January 29, showing that farmers intended to plant 4.47 million hectares of summer grains and oilseeds in the 2024/2025 season, and the preliminary area to be planted was estimated at 4.45 million hectares. Of the preliminary planted area, 2.64 million hectares were estimated to be under commercial maize (white and yellow). The latest CEC report of the 27th of June 2025 indicates that the area planted for commercial maize now stands at 2.59 million hectares, which is of 1.87% less than the initial planting intentions.

Notably, there has been a 2.89% increase in white maize area relative to the previous season, although this follows a 7.81% decline from the prior year. These shifts reflect the dynamic nature of cropping decisions under uncertain climatic and market conditions. According to the CEC, the commercial maize crop is anticipated to exceed 14.78 million tons, which is approximately 1% (139 300 tons) more than the estimate of May. From a year-over-year perspective, this indicates a 15.04% or 1.93 million tons increase, suggesting a significant recovery from the output decline last season, attributable to the drought. Crucially, these projections by far surpass South Africa’s annual maize requirements of approximately 11.8 million tons, indicating a surplus and reaffirming the country’s status as a net exporter in the global market.

Despite the optimistic production outlook, the 2024/2025 harvest has experienced a sluggish start. Although South African farmers and farmworkers have demonstrated considerable effort in harvesting the crop, delivery volumes are currently reported to be approximately 45% lower than the volume delivered during the same period last year. The delay in deliveries is attributed to early-season weather disruptions, thereby rendering harvesting about a month behind schedule. There have also been some quality concerns, particularly due to the late onset of the season and the prolonged rainfall into April.

Data from the South African Grain Information Service (SAGIS) shows that of the white maize delivered between May and June, only 72% was classified as first-grade (WM1), compared to over 90% in regular seasons. Second-grade white maize (WM2) made up 22% of May’s deliveries. In contrast, the quality of yellow maize appears robust, with 91% of deliveries rated as first-grade (YM1). As the season progresses, a more comprehensive assessment of grain quality is anticipated.

It is anticipated that 81% of the 2025 harvest will come from the three primary maize-producing provinces, i.e., the Free State, Mpumalanga, and the North-West. The forecast output for white maize remains steady at 7.6 million tons, with an estimated area of 1.6 million hectares and an average yield of 4.78 tons per hectare. Moreover, yellow maize output is projected at 7.1 million tons, reflecting a 1.99% (139,300 tons) increase from the previous estimate. This crop was planted across an area of 997,000 hectares, with an average yield of 7.16 tons per hectare.

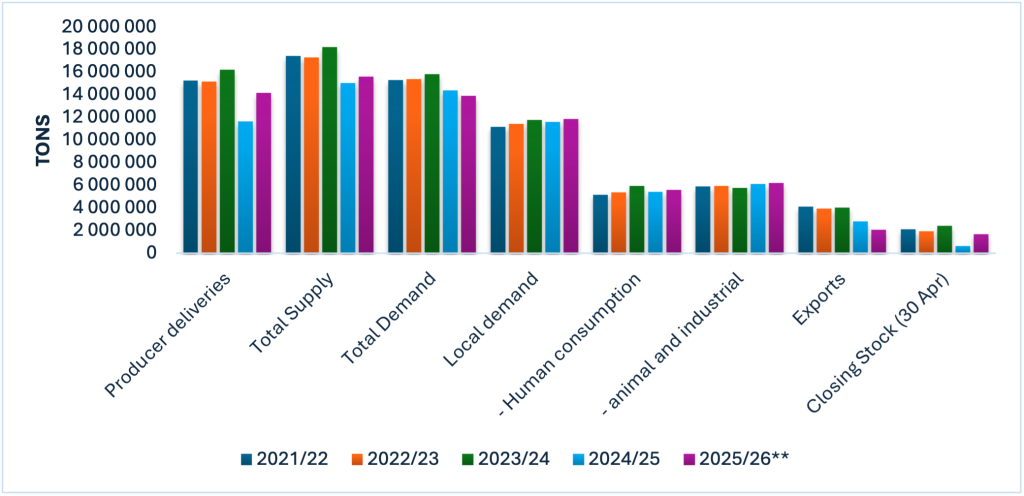

The Supply and Demand Estimates Committee (S&DEC) predicts that the overall supply for the 2025-2026 maize marketing season is comparable to 15.6 million tons (Figure 1), which is equivalent to a 3.88% increase from the final supply estimates of the 2024/25 season. The total demand is expected to reach 13.9 million tons, with domestic demand remaining stable at projections of 11.8 million tons. One of the key reasons for the sustained consumption of maize, more specifically white maize, is that it is a staple food for most of the country’s population. South Africans rely on maize as a primary source of food, given that it is a relatively more affordable option, underpinning its sustained domestic demand.

For the 2025/26 season, the committee estimated exports to reach 2 075 000 tons, of which 415 000 tons are maize products and 1 660 000 tons are whole maize. Notably, research indicates that key regional markets such as Zimbabwe, Zambia and Mozambique had relatively favourable rainfall, which is bound to boost their maize productivity, hence a likely decrease in their imports of South Africa’s maize.

Figure 1: Total Maize Supply and Demand Estimates as of May 2025

Source: NAMC

Historically, it is worthwhile to note that if countries that import large volumes of South Africa’s white maize experience favourable weather conditions, they potentially decrease their maize imports from South Africa. Data from the United States Department of Agriculture (USDA) suggests that Zimbabwe, which is one of our biggest importers of white maize planted more than 1 million hectares, and this is slightly higher than the previous season. Other reports also indicate that maize production from Zimbabwe is likely to range between 1.0 and 1.2 million tons. Therefore, Zimbabwe is likely to foresee imports of approximately 1.4 million tons, of which 90% is likely to be sourced from South Africa to meet their domestic demand. Notably, no imports into South Africa are projected during the season, owing to a more improved and larger than expected South African crop. Total maize stock available in 2025/2026 is predicted to last 47 days, which is slightly above the 45 days benchmark. This suggests that the maize industry is recovering from last season’s supply constraints.

ConclusionThe 2025-2026 season is likely to mark the turning point for South Africa’s maize sector, characterised by a strong rebound in production, despite early weather-related delays and some quality concerns. The projected surplus reaffirms the country’s vital role in regional food security and grain trade. While the pace of deliveries and the quality profile of white maize remain areas to monitor, the broader outlook is optimistic. Continued investment in good farming practices and regional-international trade coordination will be essential to consolidate the recovery and ensure long-term sustainability in South Africa’s maize industry.

Disclaimer: The views expressed in this article is solely that of Independent Agricultural Economist Robert Matsila, and does not necessarily reflect the views of Mzansi Agriculture Talk, his employers, or other associated parties.